B2B Returns Forecasting: Preparing for Large-Scale Impact

TL;DR:

- B2B returns forecasting prepares teams for large-scale returns that can fill docks with pallets or machinery.

- Forecasting uses historical data, predictive analytics, and data collection from multiple systems to predict future outcomes with stronger forecast accuracy.

- When your returns team leverages machine learning and data analytics, they gain predictive power that enhances cash flow and alleviates unnecessary warehouse stress.

- Better forecasting enables the supply chain to avoid excess inventory, respond to market conditions, and prepare for future shifts in performance.

It is easy to get away with zero forecasting in retail returns, but when it comes to B2B returns management, it is considerably more challenging. Particularly because of the scale of impact from these returns. For example, one return can equal a trailer load or shut down an entire warehouse. Ultimately, when return volumes are unpredictable, logistics teams lose control, and cash flow takes a hit. B2B returns forecasting is a no-brainer.

B2B returns forecasting helps leaders prepare for surges by teaching them to interpret historical data, identify trends in customer segmentation, and prepare the supply chain for sudden inbound volume. It also helps you to anticipate future returns accurately, which in turn enhances your ability to make better decisions.

In this article, we examine how B2B returns forecasting enables distributors and manufacturers to protect themselves from such shocks by utilizing predictive analytics to prepare for large-scale returns with speed and accuracy.

The Hidden Cost of Unplanned Large-Scale Returns

Unplanned returns create a lot of stress across your entire B2B reverse supply chain operations. To begin with, the cost of unplanned returns far exceeds the value of the returned units. And the real nature of the cost is not just in dollars or rupees. It shows up in clogged aisles, rushed freight, delayed grading, and lost time.

The first impact is financial. If your returns team cannot predict returns, they cannot plan cash flow. Large returns force refunds or credits that hit the books without warning. This disrupts the view of future revenue and weakens planning.

The second impact is operational. Equipment or pallet loads take up space that teams did not prepare for. Warehouse managers often end up stacking returns in corners, relocating stock, or requesting temporary labor. These actions cost money and slow everything down.

The third impact is customer-facing. A customer expects speed. But when dock workers are overwhelmed with unplanned volume, the return process takes longer, which erodes trust and damages relationships.

B2B returns forecasting prevents all of this by using historical trends and predictive analytics to set expectations early.

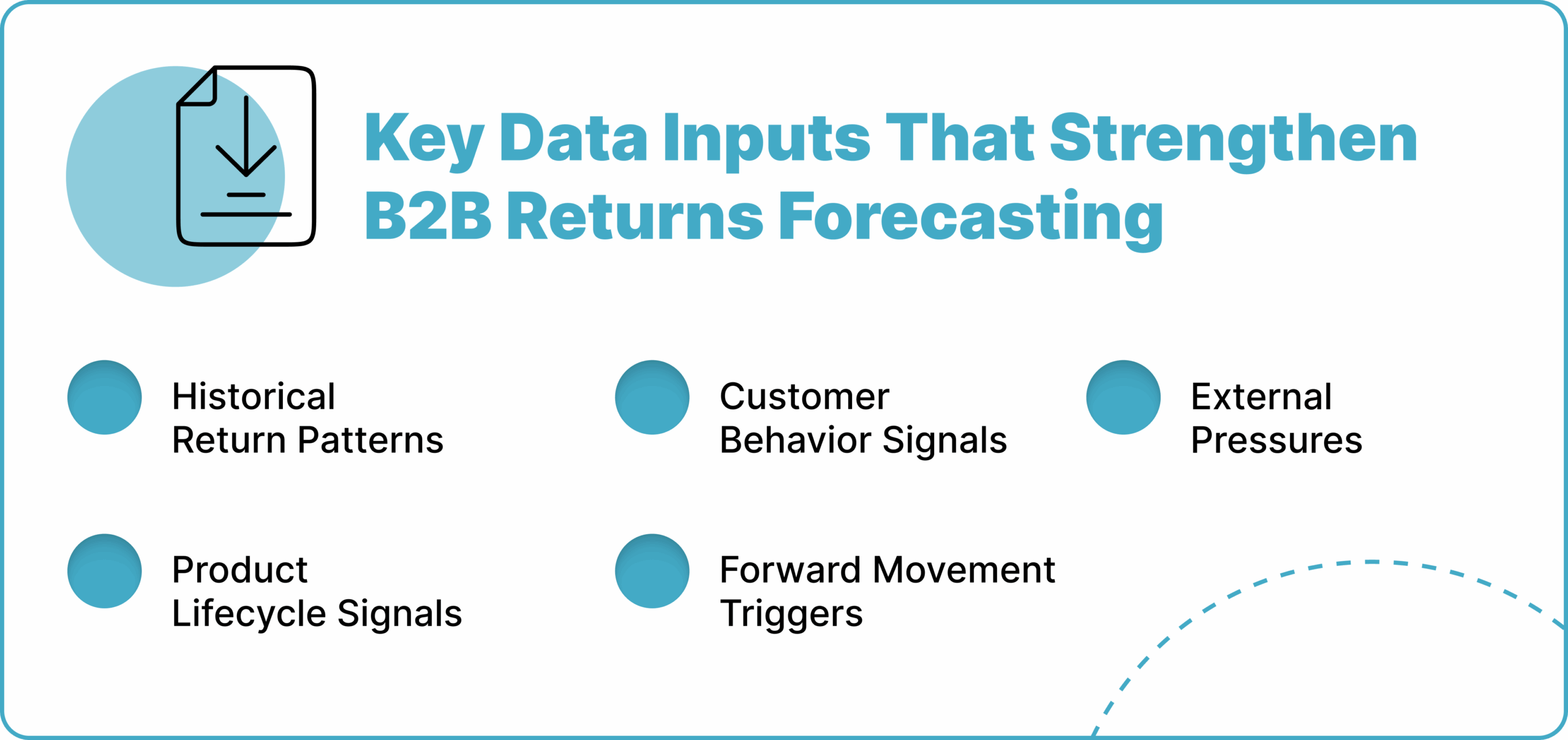

Key Data Inputs That Strengthen B2B Returns Forecasting

Accurate B2B returns forecasting begins with accurate data. Your returns team needs data that informs them how returns behaved in the past and how they may behave in the future. Some of these data inputs include:

1. Historical Return Patterns

Your returns team must analyze historical data to understand how past returns behave under certain market conditions. Historical sales data can support this because larger shipments often signal larger returns later. Tracking these patterns helps forecast future behavior.

2. Product Lifecycle Signals

Machines, components, and devices follow wear patterns. When failure rates rise at certain ages, forecasting can predict future outcomes, which is critical for helping teams prepare space and labor for items likely to return.

3. Customer Behavior Signals

Service tickets, inbound calls, and support emails offer leading indicators of future returns. Sales reps and sales managers spend time listening to and analyzing early complaints, which makes them vital sources of early warning. These signals enable teams to predict outcomes weeks in advance.

4. Forward Movement Triggers

When a customer replaces equipment or upgrades systems, they often return the old batch soon after. Predictive models can link forward shipments with reverse spikes to create forecasts that match reality.

5. External Pressures

Market research, regulatory changes, or supplier recalls can affect return volume. For example, a recall on a telecom device can trigger a rapid spike. Effective forecasting combines these external factors with internal data points to achieve stronger predictive power.

How Predictive Analytics Strengthens B2B Returns Forecasting

Predictive analytics enhances forecasting by integrating disparate streams of information into a unified, transparent model. It converts raw data into signals that help supply chain teams prepare for their tasks.

1. Pattern Detection Across Systems

Predictive analytics pulls data from ERP, CRM, warehouse management, and repair systems. By analyzing historical data with machine learning, it identifies patterns that manual review may miss. Your returns team can then rely on these patterns to help them predict future behavior across product groups, customer types, and contract models.

2. Risk Scoring for Large or High-Value Returns

Predictive models assign risk levels based on key factors, such as age, fault codes, and service history. This way, your returns team can adequately prepare for returns that may require complex handling. Regression analysis strengthens this by linking independent and dependent variables in ways that reveal return probability.

3. Scenario Planning for Warehouse Load

Analytics tools can create forecasts that test different return patterns, allowing you to run quantitative forecasting scenarios to determine how many workers or how much space is needed during a large return wave. Statistical models help managers plan campaigns to handle volume before it arrives.

4. Forecasting Return Reasons to Manage Labor

When your returns team can accurately predict the condition of future returns, they can plan technician staffing with precision. For instance, a surge in repair-needed items requires more technical labor, while a surge in open-box units necessitates more support for grading. This way, you are sure of accurate forecasting and stronger execution.

5. Automation Driven by Predictive Models

Forecasts can trigger automated routing rules in the warehouse. If a high return volume is coming, the system may reserve space, assign transport slots, or create forecasts for staffing. When executed at scale, this protects control during busy periods.

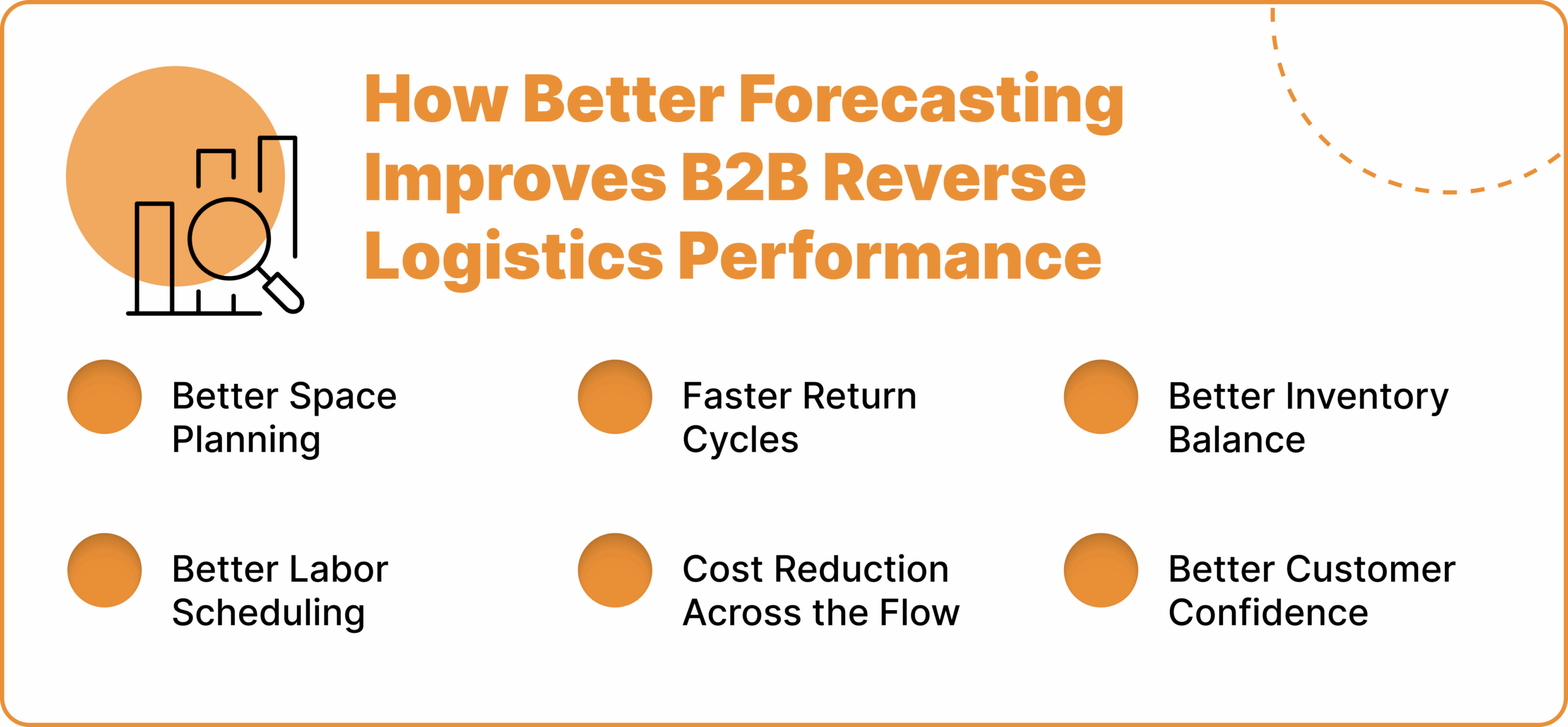

How Better Forecasting Improves B2B Reverse Logistics Performance

B2B returns forecasting improves B2B performance by stabilizing a process that often feels chaotic. When teams use predictive analytics, they gain control over the reverse flow.

1. Better Space Planning

Space can be allocated within warehouses before returns arrive. This way, your returns team can ensure that the aisles are clear and safer for workers. It also reduces the need for temporary storage space, which cuts costs.

2. Better Labor Scheduling

Forecasting enables managers to determine when to increase or reduce labor, allowing for the effective allocation of resources toward tasks that matter most. Workers experience less stress, and the process moves more efficiently.

3. Faster Return Cycles

When teams expect big returns, they pre-stage tools, labels, and parts. This speeds up the grading, inspection, and processing. Faster cycles protect cash flow and boost revenue through faster resale or redeployment.

4. Cost Reduction Across the Flow

With accurate data guiding the return flow, companies can cut freight spend, avoid emergency labor, and prevent excess inventory buildup, making the return process more profitable.

5. Better Inventory Balance

Forecasts protect against sudden stockpile jumps that confuse planners. Items enter the system with a plan, rather than piling up without direction.

6. Better Customer Confidence

Customers trust partners who run stable operations. Fast returns reinforce that trust. This trust enables sales teams to secure stronger, long-term deals.

Returns Management Tracking and Analytics With ReverseLogix

ReverseLogix is built with meaningful metrics and game-changing insights in every module. With end-to-end returns management and best-in-breed tracking and analytics, ReverseLogix is the solution to unite all your existing business technologies and deliver metrics and data to every team member.

Gain total visibility across the entire returns journey and optimize performance through forecasting to stay competitive and increase your edge in real-time. Operationalize all your data so it’s usable and understandable. Access customized reporting based on departments, user roles, or locations so that distributed teams can always stay in sync. Put ReverseLogix in your hands and unlock more value from every return.

Frequently Asked Questions

B2B returns forecasting gives teams the visibility they need to prepare for large inbound returns. By utilizing predictive analytics, data analysis, and historical data, companies can more effectively predict future outcomes and plan for warehouse space, labor, and cash flow.

Teams often analyze historical sales data, sales data from related product groups, market knowledge, and customer segmentation trends to inform their decisions. These data points help identify trends and support more accurate forecasts across the reverse supply chain.

Yes. Predictive models, supported by machine learning and artificial intelligence, help companies forecast future behavior by analyzing dependent variables, independent variables, and leading indicators. These models help teams create forecasts that prepare the business for sudden return surges.

Regression analysis connects historical trends with market conditions to uncover patterns that help teams predict future revenue risks connected to large-scale returns. Quantitative models utilize statistical models to analyze data points and identify how various factors influence future outcomes.

Forecasting helps teams avoid excess inventory, allocate resources with more precision, and prepare for longer sales cycles that can push returns back into the system later. This protects cash flow and supports strategic initiatives tied to future sales performance.