What is Customer Lifetime Value (CLV) & How to Calculate It

Customer Lifetime Value (CLV) is the total revenue a business expects to earn from one customer during their relationship. This figure shows how valuable that customer is beyond a single sale.

CLV emphasizes long-term growth instead of short-term wins. It’s key to targeted marketing, better retention, and stronger forecasting.

Why Customer Lifetime Value Matters

Customer lifetime value shows how much each customer contributes to your business over time. Customer lifetime value is vital for budgeting, forecasting, and setting growth goals. It helps companies to decide where to invest: acquiring new customers or keeping the ones they have.

Focusing on CLV helps companies align their revenue goals with customer satisfaction. The longer a customer stays and the more they buy, the more value they deliver. That’s why many brands prioritize strategies that help keep the right customers.

| What is the difference between customer lifetime value and CAC? CLV measures the revenue a customer brings in over time. CAC (Customer Acquisition Cost) is the cost of acquiring that customer. Comparing both shows whether you’re spending wisely to earn long-term value. |

Segment & Target the Right Customers

Customer lifetime value helps brands focus on the customers who matter most. By identifying high-value segments, companies can spend more time and budget on keeping those shoppers engaged and loyal.

Another element of CLV is strategic targeting. It can guide personalized messages, offers, and product suggestions that match customers’ habits. At the same time, it helps reduce wasted spending on low-value audiences that are unlikely to return.

| What is the 80/20 rule in CLV? The 80/20 rule means that roughly 80% of your revenue often comes from just 20% of your customers. CLV helps you find and focus on those top earners. |

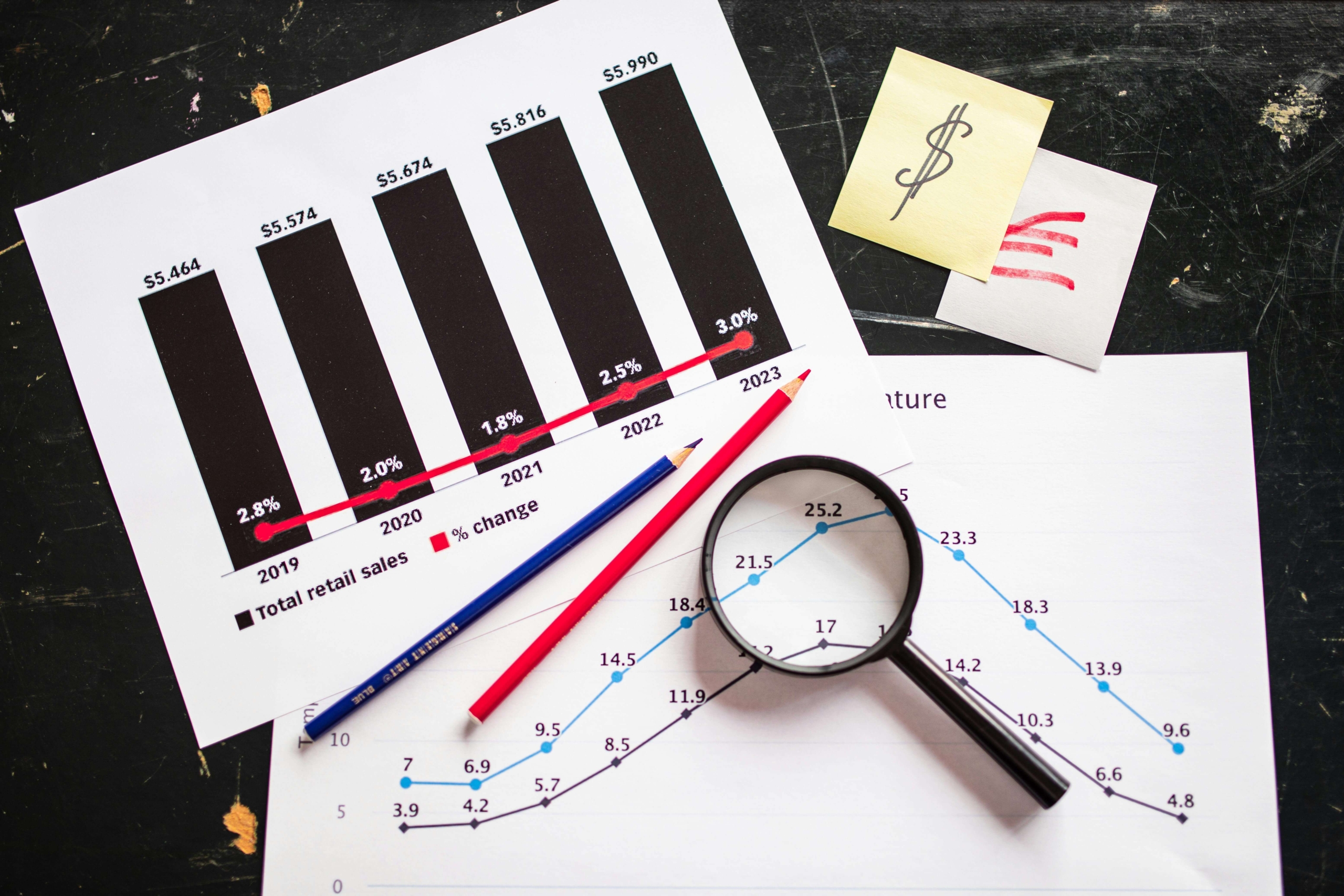

Forecast & Predict Revenue

Customer lifetime value gives businesses a clearer view of future income. Seeing how often customers buy and how much they spend helps brands make more accurate predictions about long-term revenue.

CLV also promotes better financial modeling and inventory planning. Teams know when to scale up, where to invest, and how to prepare for changes in demand. With these insights, companies can track the return on marketing and customer experience efforts more accurately.

Highlights the Customer Experience

A high customer lifetime value often signals a strong, positive customer experience from browsing to buying to returns. When shoppers are happy with their treatment, they’re more likely to return and spend more.

Factors like delivery speed, return policies, and customer support all shape how long someone stays with a brand. CLV data can highlight what’s working and where there are problems, giving teams the insights they need to improve the full journey.

Metrics that Impact & Influence CLV

Several core metrics shape a customer’s lifetime value. These insights make it easier to analyze customer lifecycles and optimize your retention strategy.

Average Purchase Value (APV)

Average Purchase Value (APV) shows how much revenue each purchase brings in. To calculate it, divide your total revenue by the number of purchases in a given period.

A higher APV means customers spend more each time they buy, directly increasing customer lifetime value. Businesses can raise APV by offering product bundles, upsells, or targeted promotions.

Tracking APV helps you spot buying trends and adjust your sales strategy to drive more value from every transaction.

Purchase Frequency (PF)

Purchase Frequency (PF) tells you how often customers buy from your brand. To calculate it, divide the total number of purchases by the total number of customers in a specific time period.

Increasing PF is an integral strategy in growing customer lifetime value. Loyalty programs, personalized emails, and timely follow-ups can keep your brand top of mind and encourage repeat purchases.

Having repeat customers shows their strong engagement and connection with your brand, two signs of long-term value.

Customer Lifespan (CL)

Customer Lifespan (CL) measures how long, on average, a customer stays active with your brand. It’s usually tracked in years and is based on the time between their first and last purchase.

A longer CL means stronger brand loyalty and more stable revenue over time. To extend it, focus on improving the customer experience: offer fast support, easy returns, and loyalty perks that keep people coming back. Customers who stick around longer are highly valuable, and are more likely to refer others.

Customer Churn Rate

Customer churn rate is the number of customers who stop buying from you during a set time. It’s shown as a percentage. A high churn rate means you’re losing customers too fast.

Churn hurts customer lifetime value because it shortens how long people stay with your brand. When customers leave early, they don’t spend as much over time.

You can lower churn by reaching out before problems grow, making sign-up and returns easy, and giving support when it’s needed.

Customer Profitability Score (CPS)

Customer Profitability Score (CPS) shows how much money a customer brings in after subtracting service and shipping costs. It helps you see who adds value and who costs more to serve.

Some customers may buy often but return too much, or need extra help. CPS helps spot those patterns. This score is helpful when setting return limits or offering different service levels. It helps you treat high-value customers well while keeping costs under control.

How to Calculate Customer Lifetime Value: Formulas & Steps

There’s more than one way to run a customer lifetime value formula. You can start with a simple version or use a detailed method to get better information. The next few sections break it down so you can measure CLV for your business.

Two CLV Formulas

There are two common ways to calculate customer lifetime value. The first is a simple formula:

CLV = Average Order Value × Purchase Frequency × Customer Lifespan

This quickly examines how much revenue one customer brings in over time. It works well for basic planning and quick decisions.

The second is more detailed:

CLV = (Average Revenue per Customer × Customer Lifespan) − Total Cost of Serving the Customer

This version factors in service and logistics costs, making it better for detailed financial modeling. No matter which customer lifetime value formula you use, both help you see long-term value more clearly.

Step 1: Calculate Average Purchase Value

Average Purchase Value (APV) tells you how much money you make per order. To find it, divide your total revenue by the number of purchases during the same time period.

Use sales data from your POS or CRM for better accuracy. Use consistent time frames, like monthly or yearly totals, when comparing different groups so your CLV numbers are fair and useful.

Step 2: Calculate Average Purchase Frequency Rate

Average Purchase Frequency shows how often your customers buy from you. To find it, divide the total number of purchases by the total number of customers for the same period.

You can track this using order history data from your CRM or sales system. If a customer’s buying rate drops, it could signal they’re losing interest. Getting that information ASAP allows you to re-engage them before they churn.

Step 3: Calculate Average Customer Lifespan

Average customer lifespan shows how long a typical customer stays active with your brand. To find it, look at the time between a customer’s first and last purchase, then average that across all customers.

This number can grow when your customer experience is strong. Easy returns, helpful support, and loyalty programs help people stay longer and spend more. A longer lifespan means higher customer lifetime value and stronger brand loyalty.

Step 4: Calculate Customer Value

Customer value shows how much revenue one customer brings in each year. To find it, multiply Average Purchase Value (APV) by Purchase Frequency (PF). This gives you a clear picture of a customer’s worth before examining their length of stay. It’s a key part of the customer lifetime value calculation and helps you track revenue at the individual level.

Step 5: Get Your Final CLV Calculation

To finish your customer lifetime value calculation, multiply Customer Value by Customer Lifespan (CL). It evaluates how much revenue you can expect from one customer over the long term. You can also use CLV to group customers by value, i.e., high, medium, or low. These segments help you decide who to target with loyalty offers, who needs more support, and where to focus your marketing dollars.

The Two Main Types of CLV Models

There are two ways to measure customer lifetime value: predictive and historical. The next sections break down how they work and when to use them.

Predictive CLV

Predictive CLV estimates a customer’s future spending based on past orders, browsing behavior, email clicks, and return history. Many companies also use machine learning tools to spot patterns people might miss.

This model is helpful for growing businesses that want to plan ahead. It can show which customers will likely buy again, which may leave soon, and how their value might change over time. These insights help brands adjust marketing, inventory, and support to focus on customers who drive the most value.

Historical CLV

Historical CLV measures how much a customer has already spent with your brand. Instead of guessing about the future, you can make decisions based on data on what’s happened. This quick, clear approach is based on hard facts.

It’s useful for reviewing past campaigns, sales channels, or loyalty programs. You can see which customers brought the most value and which strategies paid off. But because it ignores future behavior, it’s less helpful for planning or predicting growth. That’s why many businesses use historical CLV as a starting point and build on it with deeper forecasting tools.

How Returns Management & Reverse Logistics Impact CLV

Returns can determine how long customers stick around. A fair return process leads to a positive customer experience, while a bad one drives people away. The next sections show how reverse logistics can raise or lower customer lifetime value.

Returns Are Touchpoints for Customers

Every return is a chance to shape a customer’s perception of your brand. If the process is easy and fast, it can turn a bad product experience into a positive one.

Customers remember when you make things right without hassle. That goodwill often leads them to shop with you again and recommend you to others. In short, good returns protect and even grow your customer lifetime value.

A Poor Returns Experience Can Impact the CLV

Customers are quick to notice when returns are slow or stressful. Long refund times, confusing steps, or hidden fees are all major roadblocks that can drive customers away for good.

Bad return experiences often lead to churn, which lowers customer lifetime value. Even loyal buyers may not return if they feel burned by the process. That’s why making returns simple, clear, and fair is crucial so customers stay with you longer.

Efficient Returns Management Can Boost Profit Margins

Returns don’t have to be a loss. With strategic systems in place, they can protect and grow your margins. When returns are processed quickly, support teams handle fewer tickets, and items get back on shelves faster. In turn, that reduces overhead and speeds up resale or refurbishment.

Better reverse logistics also means higher accuracy, more recovered inventory, and improved cost control. The savings can fund customer retention programs or tools that improve the post-purchase experience.

| Want to see how data plays a role in streamlining returns? The Critical Role of Analytics in Your Reverse Logistics explores how insights can reduce costs and improve customer satisfaction. |

Reverse Logistics Can Build Customer Loyalty

How you handle returns plays a major part in whether a customer comes back. You want customers to feel valued, even if they return a product. That kind of trust turns one-time buyers into repeat customers.

Strong reverse logistics shows customers that you care about their time and experience, not just their money. These positive interactions create the loyalty your business needs to create higher customer lifetime value. Loyal customers return often, spend more, and recommend your brand to others.

| Curious how logistics affect loyalty? How Reverse Logistics Can Build Customer Loyalty dives deeper into why the return experience is a key driver of repeat business. |

Turn CLV Insights Into Action

Customer lifetime value shows the revenue a customer can bring over time, so you can focus on long-term value instead of one-time sales. Your CLV model should reveal patterns in behavior, highlight which customers matter most, and expose gaps in your service or logistics. Get a demo today and see how ReverseLogix can help you grow customer lifetime value with smarter returns and logistics.

Get a Demo

Discover how you can jump-start your returns management efforts with ReverseLogix.