Retail Businesses Need to Think Long and Hard on Their Returns Policies and Reverse Logistics

Businesses need to ensure service levels in reverse logistics align with forward logistics, by investing in infrastructure and policy changes to improve customer retention.

Imagine buying a name-brand food processor over the internet from a verified seller at a discount during the retail peak season. You check the reviews — they are good, and you are guaranteed a two-day delivery. The product arrives in time, you plug it in, and it works like a charm.

Things take a turn when, a month later, you see visible smoke rising up from the processor while in the middle of making dough. You unplug it and try plugging it back again. The processor is dead, as the motor seems to have burned up. Frustrated, you check the seller’s page on their return policy and drop a message on their online platform. The seller responds with a generic apology and offers to return the money when you send back the product. You ask for a replacement but the seller refuses, mentioning that you have to re-order again as the price of the product has risen in the meantime.

Defeated, you search for a way to return the product. “$5 to send someone to pick it up from your doorstep,” informs the returns fine print. “Or you can return it for free at the nearby drop-off point.”

You don’t want to waste money on returning the product, the processor is bulky, and you’ve thrown out the original packaging. So you gingerly pack it in a rather large cardboard box and hand deliver it to the shipping store. “All this hassle for something that was not my fault to begin with, and I have to pay $20 more to buy the same mixer?” you wonder.

For customers navigating the intricacies of return policies, the experience can often become a crucial consideration, influencing future purchasing decisions. Stonewall responses, lack of flexibility in returns, and imposition of return fees can put off customers, prompting them to seek alternatives where the return process is more customer friendly. In retail, where service levels end up being the unique value proposition, a hectic returns process can significantly impact top-line numbers.

In many cases, the reasons behind product returns are within the control of the brand or retailer. For instance, a product might not work as expected, there could be discrepancies between how it’s represented online and what is received, delivering the wrong item, damaged on arrival orders, or just poor packaging. Making the returns process challenging — particularly for issues not caused by the customer — can exacerbate tensions, potentially alienating already irate customers.

Alternatively, brands can offer credit upon scanning the return and verifying the return’s legitimacy. This can encourage customers to drop off returns, especially if there are incentives like faster credit processing. Presenting tailored incentives during the return process could transform a potential loss into an opportunity for further engagement. A customer considering a return due to a minor issue like a color discrepancy might be persuaded to retain the item in exchange for a discount on future purchases.

Retailers can leverage physical store returns by offering incentives for in-store returns, driving foot traffic, and encouraging immediate additional purchases. At its core, the focus is on making the returns process as simple and hassle-free as possible, while exploring opportunities to enhance the overall experience and possibly gain business with upsells.

Brands need to recognize the importance of aligning the quality of service in both forward and reverse logistics. Considering physical store visits have declined, the customer’s desire for immediate gratification is reflected via the expectation for rapid delivery of online orders. The forward logistics process, from order receipt through e-commerce platforms to warehouse management and delivery, has been optimized for speed and efficiency.

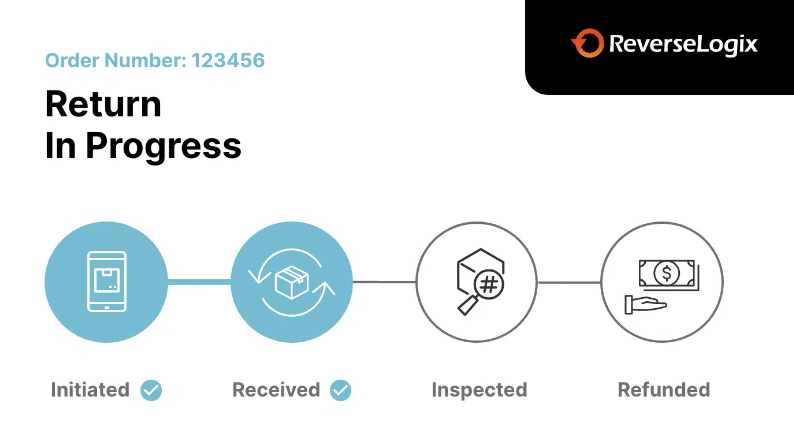

However, the same cannot be said of reverse logistics. While there’s significant technology and system investment in getting the product to the customer, the backend processes for returns are less developed. Companies need to invest in reverse logistics to understand data points like the percentage of products returned, reasons for returns, and the time taken from initiating a return to processing it in a warehouse.

Building the backend logistics infrastructure does take time, but adjusting return policies to be customer-friendly can bring an immediate improvement to operations. With data to back decisions, companies can work towards cost minimization, improving returns efficiency especially at the warehouse level, predicting and planning for returns, based on product categories and peak seasons. The ultimate aim, though, is to reduce the volume of returns over time.

Companies that lack an understanding of their returns often measure success at a gross sale level rather than net sales. In a high-volume, low-margin business like retail, such an inefficient measure of sales could compress margins even further.

From a retailer or brand perspective, there’s immense potential in consolidating returns for cost minimization. Instead of sending individual items back through the entire supply chain to a warehouse, consolidating them at a point and sorting them for grouped travel can help. Returns don’t require the same urgency as initial deliveries, so even if consolidation takes a bit longer, it can result in significant shipping cost savings.

Once returns reach the supply chain and warehouse, technology can be leveraged to process them efficiently. Instead of letting returns accumulate and become an onerous task, the right technology can integrate return processing with other workflows. Aside from enhancing efficiency, it enables data collection, that can provide insights for decision-making on the forward side of the business.

As online shopping surpasses physical retail, investing in a seamless, intuitive return process becomes paramount. Retailers banking on data-driven insights for cost minimization and predictive planning can turn returns into opportunities for reinforcing brand value and customer relationships. The goal is to replicate the meticulously designed initial purchase journey with the returns journey — creating a comprehensive, customer-centric shopping experience that boosts retention and the bottom line.